Making the case for CX in times of uncertainty

Meet the experts Peter Fader Topher Mitchell Co-founder and Director, Theta Manager, Center of Value, Professor of Marketing, The Wharton Qualtrics School, University of Pennsylvania Daniel McCarthy Madeline Lee Co-founder and Director, Theta Analyst, Center of Value, Assistant Professor of Marketing at Emory Qualtrics University’s Goizueta Business School We partnered with our friends at Theta for this ebook.

Table of 01 From easy money to tight money contents 02 How economic uncertainty is impacting customer experience 03 How to move forward with confidence 04 Focus on ROI to balance costs and loyalty 05 Making the business case

SECTION 1 From easy money to tight money

From easy To say the global economy has changed in the past few months is an understatement, with money to multiple factors converging to create an uncertain future for many: tight money + Fiscal policy: Governments around the world responded to COVID-19 with stimulus payments north of 20% of GDP. This injection of cash into their economies, along with other factors, has fueled substantial inflation. + Monetary policy: Governments are moving out of a low interest rate environment with some of the largest rate increases seen in decades. For example, the US Federal Reserve raised rates by 0.75% in June, the largest increase since 1994. + Stock market performance: We are moving from one of the best bull markets ever to a bear market as concerns rise over inflation, interest rates, the war in Ukraine, supply chain issues, and more. + Consumer confidence is at an all-time low: The consumer sentiment index reached 50.2 in June 2022, the lowest recorded level since tracking began in 1952. + Corporate response: Many companies are engaging in mass layoffs, hiring freezes, and corporate spending cuts.

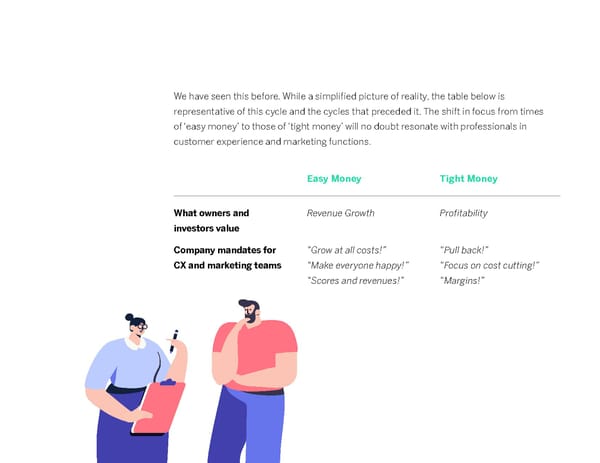

We have seen this before. While a simplified picture of reality, the table below is representative of this cycle and the cycles that preceded it. The shift in focus from times of ‘easy money’ to those of ‘tight money’ will no doubt resonate with professionals in customer experience and marketing functions. Easy Money Tight Money What owners and Revenue Growth Profitability investors value Company mandates for “Grow at all costs!” “Pull back!” CX and marketing teams “Make everyone happy!” “Focus on cost cutting!” “Scores and revenues!” “Margins!”

SECTION 2 How economic uncertainty is impacting customer experience

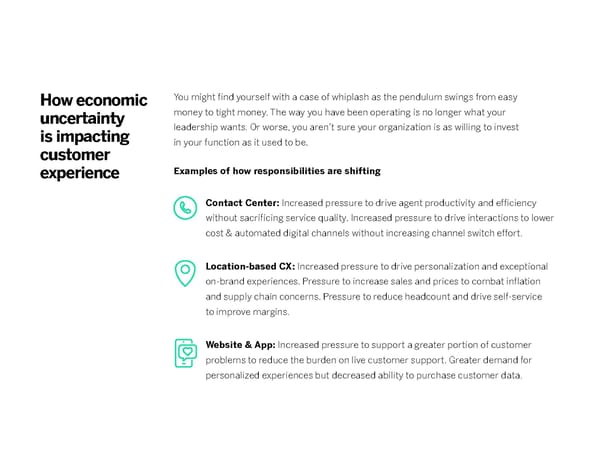

How economic You might find yourself with a case of whiplash as the pendulum swings from easy uncertainty money to tight money. The way you have been operating is no longer what your is impacting leadership wants. Or worse, you aren’t sure your organization is as willing to invest customer in your function as it used to be. experience Examples of how responsibilities are shifting Contact Center: Increased pressure to drive agent productivity and efficiency without sacrificing service quality. Increased pressure to drive interactions to lower cost & automated digital channels without increasing channel switch effort. Location-based CX: Increased pressure to drive personalization and exceptional on-brand experiences. Pressure to increase sales and prices to combat inflation and supply chain concerns. Pressure to reduce headcount and drive self-service to improve margins. Website & App: Increased pressure to support a greater portion of customer problems to reduce the burden on live customer support. Greater demand for personalized experiences but decreased ability to purchase customer data.

CX and Marketing Digital Marketing: Pressure to provide human-like authentic experiences, fueled teams that don’t have by empathy, in an increasingly digital world. Challenge to create human connections a robust approach to at the right moment. measure the impact of investments will Let us be clear - what financial markets (and thus senior leadership) struggle to get the are rewarding has changed. resources they need. With different incentives and orders come different tactics. CFO’s and other decision This requires a data- makers will adjust their strategies based on what owners and investors value. This shift backed and customer- in strategy makes its way down the ranks in the form of harder-to-access budget for all centric approach.” investments – new, old, recurring, one-time… you name it. Peter Fader Theta

SECTION 3 How to move forward with confidence

How to move These constraints make it even more important to show what the dollars are doing. forward with This is not a new story – we would advocate for it in good times and bad – but it is confidence especially important right now. When money is tight, operators are tempted to cut all forms of spending, but this often does more harm than good. Cutting all forms of spending can affect service levels and the customer experience. It increases the likelihood that experiences fail to meet expectations which can often cause customer frustration and churn. Across industries, bad experiences put a business at risk of losing an average of 9.5% of its revenue. Instead, operators should divert all unproductive, low-return spending towards investments that will generate a high incremental rate of return. In other words, invest where it counts and be able to justify your investments to key stakeholders.

The contact center is key to keeping customers As inflation impacts purchasing power, competition for share of household income and budgets grows fiercer. Meanwhile, budget-constrained organizations often shift their focus in favor of retaining existing customers. Customer loyalty is harder fought for and easier lost than ever. Organizations can’t give valuable customers a reason to leave, which makes points of customer interaction, such as contact centers, critical. Contact center operators are smart to tune into the root causes of customer frustration and delight. These insights will allow them to maintain the service experience across channels and to quickly resolve issues. Striking the balance between customer experiences and behaviors helps professionals keep costs down without sacrificing loyalty.

SECTION 4 Focus on ROI to balance costs and loyalty

Focus on Justifying investments goes beyond relying on company revenue growth or satisfaction ROI to scores. It requires you to understand how your initiatives are impacting customer balance acquisition, retention, spend, and cost to serve. You must link your CX and Marketing costs and investments to customer unit economics. loyalty Customer Unit Economics & Lifetime Value + Customer unit economics is the study of all marginal revenue and costs attributable to individual customers. This includes the upfront costs to acquire customers, current and future revenue associated with customers after acquisition, as well as the costs associated with that revenue. + Customer lifetime value is the present value of all cash flows associated with a customer.

Understanding the This means customer-level data. It also means measuring and tracking these behaviors relationship between and their drivers over time (as opposed to ad hoc, point-in-time analyses). And it means customer sentiment building stronger partnerships with your Finance colleagues. These types of efforts will and behavior is a yield immediate benefits such as the improved ability to: strategic advantage. It + Generate budget and support for your initiatives. Understanding the implications will help you generate on customer acquisition, retention, development, and cost to serve – and how they support, increase come together into overall profit lift – will provide you a clearer view of the return on cross-functional your investments. It will allow you to diagnose performance, building credibility alignment, and make within your organization. decisions that drive + Increase alignment between Finance, Marketing, and CX functions. profitable growth.” Sharing language and metrics across Marketing, CX, and Finance will foster better Topher Mitchell alignment. These groups often have shared objectives and complementary capabilities. Qualtrics It will also allow your organization to make apples-to-apples comparisons across unrelated types of initiatives.

+ Make better CX and Marketing investments to drive profitable growth. A better understanding of Customer Lifetime Value is highly actionable. Organizations need to know what it is, how it varies across customer segments and over time, and what drives it. For example, which customers are most valuable and what moves the needle for them? How can we target other products to our best customers? (existing customers are 50% more likely to try your other products than new customers). Can we establish a referral program based on our “best customer” profile to find more like them? How can we optimize the customer experience for our less profitable customers? While being a critical move for the short-term, it’s also the right move for the long-term. Organizations that respond better to crises or recessions tend to have benefits that persist longer than the crisis. For example, organizations that maintained an innovative focus during the 2009 financial crisis outperformed the market average by over 30%. And they continued to show accelerated growth over the next 3-5 years. And monitoring the health of customer relationships allows you to respond to the evolving economic environment. According to research conducted by XM Institute, during the pandemic and ensuing uncertainty, we saw CX leaders outpace their industry stock performance by a massive 45 percentage points.

SECTION 5 Making the business case

Making the To all who find themselves making the case for investment, we recommend you: business case 01 Align your team on targeting Marketing and CX strategies towards the highest value customers. Rather than solving for “the average customer,” solve for the highest value customers. 02 Gain access to the right customer-level data. If it isn’t as available as it should be, make the case to your organization of why it is critical, especially in this environment 03 Make a friend on the Finance team. Set up a cadence to review the relationships between your initiatives and customer unit economics. 04 Build the customer behavior data models to uncover growth opportunities. If you don’t have the capacity or capability, find a strong partner to help you

Ready to get started? BOOK DEMO